Chaikin Analytics provides the following types of Bullish & Bearish Alerts:

|

Alert |

Description |

|---|---|

| Power Gauge Alerts | Stocks whose Power Gauge Rating has become Bullish or Bearish as of a result of the most recent update. |

| Earnings Surprise Alerts | Companies which have reported quarterly earnings different from the analyst consensus estimate. |

| Estimate Revision Alerts | Companies whose consensus earnings estimate for the upcoming quarter has changed (by at least $.02 and 2%). |

Note: Alerts are processed between market close and the following open and are available each morning, except Earnings Surprise Alerts which update multiple times during the trading day.

There are several ways to access Alert Information. You may set up a daily Alert Email. If there is an active alert on a stock, it will appear when the stock is on an active list.

You may also view any alerts (and signals) on a given list by switching to the Alert View in the Workspace Section. You may access the Alert View by clicking on the icon listed below.

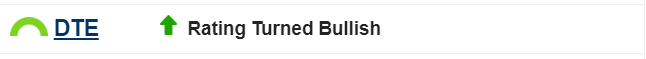

Power Gauge Alerts

Power Gauge Ratings are updated before each trading day, generally by 7:30am EST. Alerts are generated for any stock which has become Bullish or Bearish as a result of the update. (Note: there is no Alert if a Bullish stock moves to “Very Bullish” or a Bearish stock moves to Very Bearish).

Date: The effective date of the alert – generally, the date of calculation.

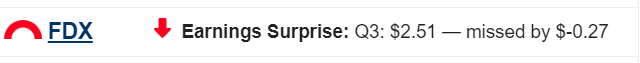

Earnings Surprises

Earnings Surprises can be a primary driver of volatile market activity.

Chaikin Analytics receives quarterly Earnings announcements multiple times during the trading day. Stocks where the actual reported quarterly EPS differs from the consensus estimate generate an Earnings Surprise Alert.

We have found that stocks with Very Bearish Power Gauge ratings are at higher risk for negative earnings surprises, and the converse is true for Very Bullish ratings. This is because Power Gauge factors, such as those in the Expert Opinions component, look at the activity of various market participants like Analysts, Short Sellers, and Company Insiders who may have a more accurate picture of a company’s earnings dynamics. You can use this fact to help position you ahead of earnings announcements.

Date: Date of the earnings announcement.

Price: Actual reported quarterly EPS.

Est: Consensus estimate quarterly EPS.

Pct: Percent difference between Estimate and Actual.

Estimate Revisions

Changes in analyst Earnings Estimates can also be significant drivers of market activity.

Chaikin receives consensus quarterly estimates nightly after each weekday, and generates Estimate Revision Alerts when the new estimate differs from the previous estimate by more than 2 cents per share (and 2%).

Old: Previous consensus earnings estimate for upcoming quarter.

New: New consensus earnings estimate for upcoming quarter.

Pct: Pct difference between Old and New estimate.