As a final step, the raw Rating may be adjusted to account for strongly trending stocks by applying a “technical overlay“, which can clip the Rating to “Neutral+” or “Neutral-“.

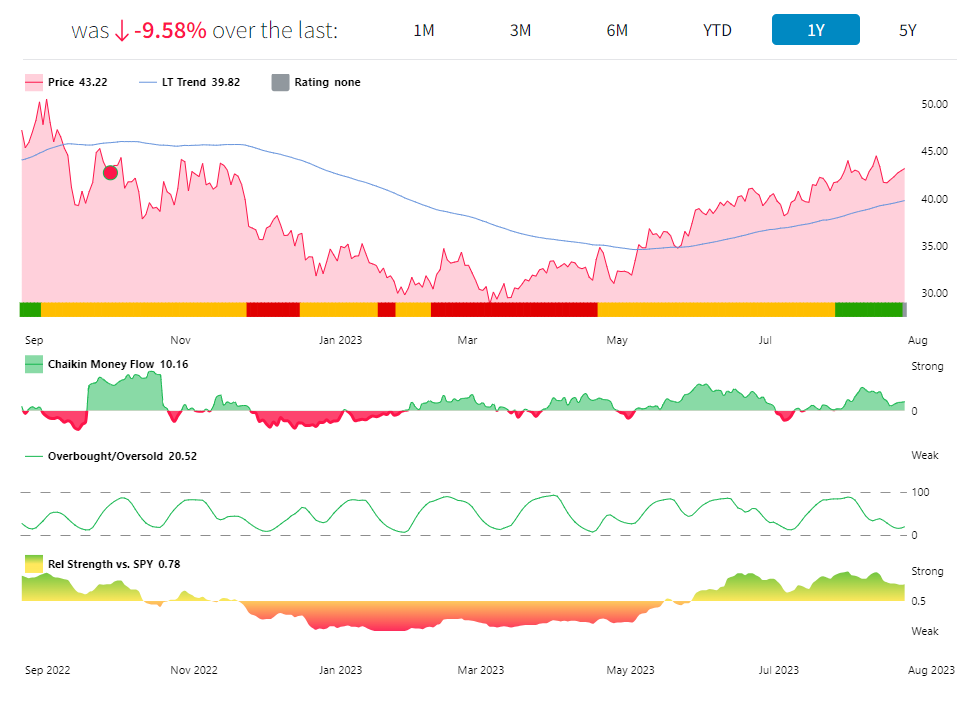

For Very Bullish or Bullish stocks that close below the 200-day trend, their Power Gauge Rating is temporarily lowered to Neutral+. It gets restored to Bullish when the stock closes back above the trend, as long as the raw Rating remains Bullish.

Conversely, Very Bearish or Bearish stocks that cross above their long-term trend have their Power Gauge Rating temporarily improved to Neutral-. It returns to Bearish when the stock closes back below the trend, assuming the raw Rating remains Bearish.

This adjustment is made when the raw Rating doesn't align with the stock's actual technical condition, indicating potential market factors not considered by the model.

When a Bullish stock goes below its long-term trend, it becomes riskier, so the Neutral+ adjustment acts as a circuit breaker, reducing model risk and volatility in returns until the stock aligns with its Rating again.

The Chaikin Power Gauge model adapts to overall market trends: when many stocks are declining, the overall ratings tilt Bearish, and when many stocks are rising, the ratings lean Bullish.

Exception. A Bearish stock which closes above its long-term trend will remain Bearish if DEMA (double exponential moving average/the blue line on the chart) is falling.