✨ The Screener helps you find strong stock and ETF opportunities that match your investing goals. Whether you're focused on growth, value, trends, or signals, this tool helps you narrow down your choices fast.

🔍 What Is the Screener?

The Chaikin Screener is a tool that helps you filter through thousands of stocks or ETFs using different criteria like:

- Power Gauge Rating

- Technical signals

- Performance stats

- Buy/Sell signals

- Fundamentals (for stocks) or ETF-specific data

You can build a screen from scratch or start with one of our Preset Screens that follow proven strategies.

📅 Data is refreshed every weekday morning and once on Saturday.

For a breakdown of what each filter does and how to use it, visit our Screener Criteria Glossary.

💡 Why Use the Screener?

The Screener helps you cut through market noise and zero in on stocks or ETFs that meet your exact needs. It’s perfect for:

- Identifying new opportunities based on the Power Gauge

- Creating shortlists for further research

- Finding swing trade setups with Overbought/Oversold signals

- Comparing ETFs in the same category to find the strongest performer

- Spotting personality changes (bearish to bullish or vice versa) early

📍 Whether you're hands-on daily or looking for a shortlist each week, the Screener is a flexible, powerful tool.

🔖 Choose: Stock or ETF Screener

When you open the Screener, your first step is to pick whether you want to screen stocks or ETFs. Each one offers different filter options:

✅ Stock Screener

- Includes all four Power Gauge factor groups: Financials, Earnings, Technicals, Experts

- Combines fundamentals and technicals with buy/sell signals

- Filter by trends like strong earnings, price movements, or Money Flow

- Choose from stock groups like the Russell 3000

- Great for identifying strong candidates for long-term investing, swing trades, or research ideas

📈 ETF Screener

- Uses Power Gauge Ratings based on:

- Chaikin’s ETF Technical Rank

- The Power Gauge Ratings of stocks inside the ETF

- A weighted score based on the ETF’s holdings

- Instead of fundamentals, filter by ETF features like sector, asset class, or expense ratio

- Helpful for comparing sector rotation opportunities or finding low-cost exposure to strong themes

⚠️ Only U.S. equity ETFs get full Power Gauge Ratings. Other ETFs may show limited info.

🔹 How to Run a Screen

By default, the Screener opens with the Russell 3000 selected as the starting universe and filters set to show stocks with a Bullish or Very Bullish Power Gauge Rating. You can adjust these settings at any time to match your needs.

- Choose Stock or ETF.

- Select your starting universe (like “Russell 3000” or “All Rated ETFs”).

- Add your filters:

- Power Gauge Rating: Focus on Bullish or Very Bullish stocks to find top-rated names

- Technical indicators: Use Overbought/Oversold to time entries or spot reversals

- Performance: Look for consistent strength with 1-month, 3-month, or 6-month returns

- Buy/Sell Signals: Zero in on fresh signals for possible near-term moves

-

For ETFs: Filter by category, region, and cost to match your portfolio goals

- Click Get Results.

- Click Update Results if you change any settings.

👀 Viewing the Results

The results look like a stock list. You’ll see:

- Ticker and Company/ETF name

- Power Gauge Rating

- Price and daily percent change

- Power Bar (for ETFs only)

You can:

- Click View in Workspace to see a temporary list

- Click Save Results to turn the results into a custom Watchlist

🔗 Temporary lists are replaced the next time you run a screen unless saved.

🔍 Preset Screens

Preset Screens are ready-made filter combinations designed to help you get started quickly. They’re especially useful if you’re new to the platform or want to explore a specific strategy without building a screen from scratch.

How to Find Them

- Click on the Screener from the main navigation bar.

- In the upper-left corner of the screener interface (next to the screen name box), click the folder icon.

- A dropdown menu will appear with a list of saved screens and preset options.

- Preset Screens are labeled by strategy type, such as “Classic Bull,” “Swing Trade,” or “Bullish Checklist.”

-

Click on a preset to load its filters and criteria. You can then adjust it or click Get Results to use it immediately.

Available Presets and Their Purpose

- Bullish Checklist: Finds stocks that meet all 6 criteria on the Power Gauge checklist—ideal for those who want full alignment.

- Classic Bull (Large/Small Cap): Highlights long-term bullish setups using price trends, volume, and fundamental strength.

- Swing Trade (Bullish/Bearish): Designed for shorter-term trades using Overbought/Oversold, Money Flow, and momentum filters.

- Personality Change (Bullish/Bearish): Shows stocks that have shifted behavior—great for spotting early reversals.

- Fundamental Growth: Filters for companies with strong growth metrics, like high earnings and sales growth.

- Value on the Move: Looks for undervalued stocks with improving fundamentals, signaling a potential breakout.

-

Bullish Insiders: Targets stocks that are Bullish and also show insider buying—helpful for confirmation.

All Preset Screens are customizable. After loading one, you can modify filters, add new conditions, or remove criteria. If you make changes you like, save your version by clicking the Save icon.

📅 Preset Screens are a great way to test new strategies, learn how filters interact, and uncover stock ideas with minimal setup.

💾 Saving and Managing Screens

-

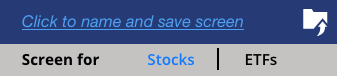

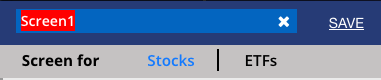

Click the Click to name and save screen button icon to name and store your screen.

- Access your saved screens from the dropdown menu.

- Use Duplicate Screen to tweak a saved screen without changing the original.

- Click Reset to clear everything and start fresh.

-

Delete a screen from the menu after loading it.

⚙️ Tips for Better Results

- Start with small changes to see how filters impact your list.

- Use Preset Screens as a base and adjust for your needs.

- ETF screens are great for comparing sector funds or narrowing by cost or size.

- Use tools like Money Flow or Relative Strength to catch momentum shifts early.

- Don’t forget to save any custom screen you plan to reuse.

Additional Ideas:

- Rotate through sectors: Use the ETF screener to explore which sectors are currently strongest based on Technical Rank or overall Power Gauge strength.

- Follow earnings trends: Screen for stocks with a Bullish rating and recent earnings surprises for potential momentum.

- Create a short candidate list: Identify Bearish-rated stocks with weak Money Flow and Relative Strength.

- Build a dividend-focused screen: Filter for Bullish-rated stocks with consistent Free Cash Flow and performance above the S&P.

- Clean up your watchlist: Use the screener to revisit stocks you’re holding and spot any with weakening ratings.

❓ Still Have Questions?

Need help setting up screeners or understanding what they do? 📞 Call us at 1-877-697-6783 or reach out through Support — we're happy to walk you through it.

Next up: Learn how to compare ETFs side-by-side with our ETF Comparison Tool.