Overview

Just as Pandora creates a channel of songs based on an artist, and Netflix suggests movies similar to ones you’ve watched, the Chaikin Stock Discovery engine automatically suggests potentially profitable stock ideas based on a stock or ETF you specify.

The first time you visit the Discovery page, you’ll see results populated based on the active Chart symbol.

To see new stock ideas, just type a ticker or Company Name into the symbol entry box and press “RETURN“. The display will populate with buy and sell ideas, based on significant factors of the “target” stock or ETF you have entered, which the Discovery Engine automatically identifies.

Results are ordered by a proprietary Relevance score which combines similarity in Industry, Market Cap, and Technical factors, as well as Chaikin Power Gauge Rating.

In this way, the Chaikin Stock Discovery engine is the first financial search engine to combine strength of search match with alpha – the likelihood that a stock will outperform the overall market.

You are among the first to use this breakthrough method for simplifying the idea generation process. I

Results

The Discovery Results display consists of a Header, followed by one or more Results lists, with Panels for each item in the list.

General Navigation

Header Hotlink

- Hover over (or tap) the ticker symbol in the Header to highlight it in blue.

- Click (or tap again) and you will be taken to a chart of the Stock.

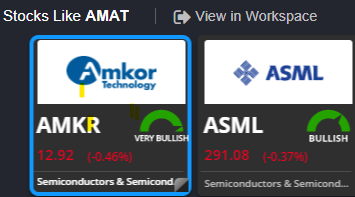

Panel Flip and Hotlink

- Hover over a Panel to highlight it, then click (or tap) to chart that symbol in the Workspace.

- Click or tap the Page corner to flip the panel and see a Stock or ETF’s significant factors.

- Move off the Panel, or tap the corner again, to flip it back.

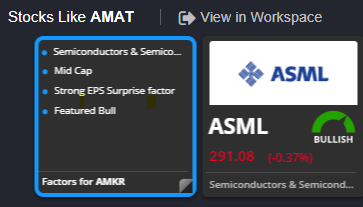

Results List Hotlink

- To view results, click on 'View in Workspace' next to one of the categories

- It will be displayed in the Watchlist, and its first symbol will be charted.

- The list will be named “Discovery Results”, and saved in the User Lists section of the List Navigator.

- The next time you hotlink a list from Discovery, it will overwrite the previous “Discovery Results” list.

- To permanently save a Results list:

- Open the User Lists section of the List Navigator.

- Hover over the “Discovery Results” list.

- Select the ‘pencil’ icon.

- Rename the list to your desired name.

Header

The Discovery Results header shows the following information for the target Stock or ETF:

- Logo

- Last price, today’s change, and percent change

- Chaikin Power Gauge rating (for Stocks)

- Significant Factors (up to 6)

Stock Discovery Results

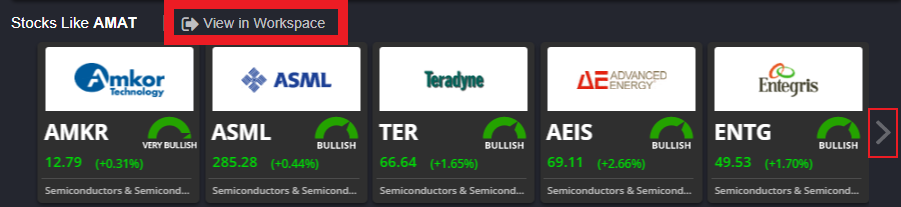

Results lists can contain up to 20 stocks, displayed in sets of 5 at a time, with arrows “< >” indicating whether there are more results before or after the current set. Press these arrows to move back and forth through a list, 5 stocks at a time.

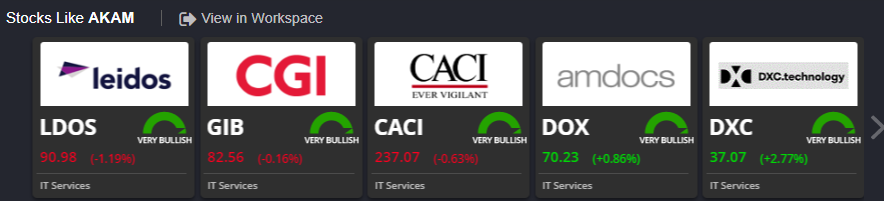

Stocks Like This

The “Stocks Like This” list contains stocks in the same Sector as your target stock, which meet Market Cap and Technical similarity constraints and have a similar or better Power Gauge Rating.

- Bullish and Very Bullish stocks are suggested for target stocks with a Power Gauge Rating of Neutral and above.

- Bearish and Very Bearish stocks are suggested for stocks with a Power Gauge Rating of Bearish or worse.

- Stocks with higher overall similarity and stronger Bullish or Bearish Ratings are preferenced.

In the example above, for the target stock ALL (Allstate Corp) – a Bullish, Large Cap Insurance company – other similar stocks such as AWH (Allied World Insurance), RE (Everest Reinsurance), and AHL (Aspen Insurance Holdings) are suggested.

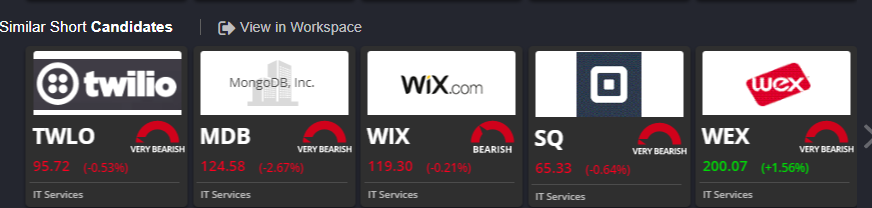

Potential Swaps / Short Candidates

One of the most powerful features of Chaikin Stock Discovery is its ability to suggest “Swaps” – similar stocks sharing an industry, but with opposite Power Gauge Rating and Technical orientation.

- Entering a Bearish stock may generate a list of Bullish “Potential Swaps.”

- Entering a Bullish stock may generate a list of Bearish “Short Candidates.”

In the example above, CBS – a Bullish, Large Cap stock in the Media Industry Group – is the top suggested Swap for TV (Grupo Televisa) – a Bearish Large Cap stock also in the Media group.

These lists can be instrumental either for Pairs trading, where a trader might go long one stock and short another (often in the same industry), or simply to improve the health of a portfolio by maintaining overall allocation in an Industry you like, but swapping from a Bearish to Bullish stock in that Industry.

Note that lists will expand criteria to fill up to 5 results if “best” matches cannot be made.

Similar Rating Lists

Many investors have certain preferred factors they look for when taking a position – such as strong Net Free Cash Flow, Bullish Expert Activity, or low Short Interest. A powerful feature of the Stock Discovery engine is its ability to suggest stocks which share significant Power Gauge Rating factors with a target stock you enter.

“Similar Rating” lists will contain stocks whose most significant factors have a high degree of similarity with your target stock, meaning they are Bullish, Bearish, or Neutral for similar reasons.

In the example above, LDOS (leidos) is in the IT Services space and is a Large Cap Stock with Strong Earnings Consistency Activity. The Discovery engine uses to surface a list of other stocks, also with Bullish Expert Activity.

“Similar Rating” lists may simply be named “Similar Bulls”, “Similar Bears”, or “Similar Neutral Stocks” – or may be named after a specific shared factor (such as “Other Stocks with Bullish Expert Activity”).

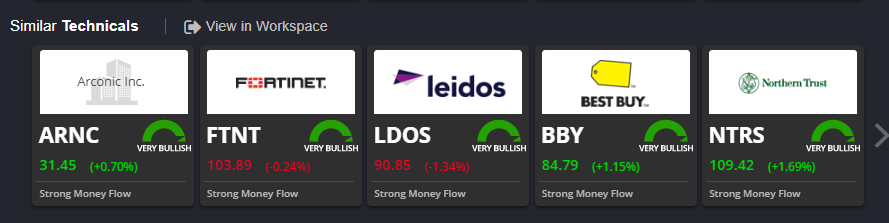

Similar Technicals

The Stock Discovery engine will also automatically detect significant technical attributes including strength or weakness in price trend activity, Chaikin Money Flow, Relative Strength, and recent Chaikin Buy/Sell Signals. “Similar Technicals” lists will contain stocks whose significant technical factors have a high degree of similarity with the stock you enter. If no covered stocks have similar Technicals, Similar Neutral Stocks will be shown.

In this example LDOS has Similar Technicals to the AMAT the symbol entered into Discovery.

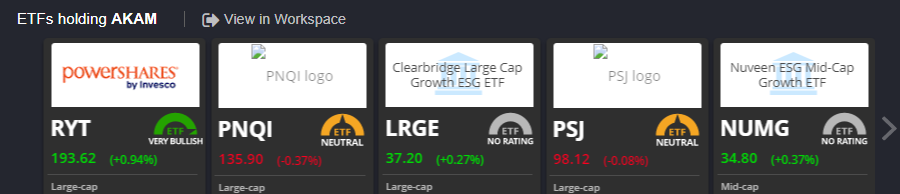

ETFs Holding This

For most stocks (and some ETFs) you enter, you’ll see a list of ETFs which hold it.

You’ll first see ones with fewest constituents, preferencing those with the strongest Chaikin Power Bar ranks (the highest percentage of Bullish stocks)

Earnings Activity

Stocks with Bullish or Bearish Earnings activity (an Earnings Surprise, or Estimate Revision alert today) may generate a list of stocks with similar Earnings Activity.

High Dividend Stocks

If a stock reliably pays out a high dividend, a “High Dividend” list will show other high yield stocks, preferencing similar stocks with stronger Ratings. This should give yield-based investors a way to quickly find opportunities meeting their requirements that have the best chance to outperform.

If a stock reliably pays out a high dividend, a “High Dividend” list will show other high yield stocks, preferencing similar stocks with stronger Ratings. This should give yield-based investors a way to quickly find opportunities meeting their requirements that have the best chance to outperform.

Recent Issues

If a stock has begun trading within the last year, a Recent Issues list will show other stocks that have also begun trading recently, preferencing the most similar stocks with strongest Technicals.

If a stock has begun trading within the last year, a Recent Issues list will show other stocks that have also begun trading recently, preferencing the most similar stocks with strongest Technicals.

These stocks will not have a Power Gauge Rating, which requires a year of trading activity in order to generate a valid value.

ETF Discovery Results

Other Similar ETFs

If you enter an ETF, you will see other ETFs which share its Category (Sector, Growth/Value, Market Cap, Dividend, Strategy, etc.), preferencing those with the strongest Chaikin Power Bar ranks (highest percentage of Bullish constituents).

ETF Top Holdings

If you enter an ETF, you’ll see a “Top Holdings” list showing the ETF’s constituents by weight, largest to smallest.

General Note

The architecture of the Discovery engine enables Chaikin to tune the Relevance algorithm based on user activity, and to add or remove lists which may be useful, or underused. So, you may see slightly different results from what is shown in this User Guide.

FAQs

What is “Discovery”?

“Discovery” is a popular and intuitive form of Search, where results are generated by an app or website when the user selects a target item (such as a musical artist, song, movie, or product), or automatically based the on a User’s activity.

- Netflix suggests movies similar (in various ways) to ones you’ve watched.

- Pandora creates channels of songs based on an artist.

- Spotify suggests songs based on ones you’ve listened to.

What is “Stock Discovery”?

We have created a Stock Discovery Engine to automatically suggest Buy and Sell ideas, based on a ‘target’ Stock or ETF of your choosing. The suggestions are both similar to the target, and have a high likelihood of investment success, as indicated by our proprietary Chaikin Power Gauge Rating.

How does it work?

When you enter a Stock or ETF, the Discovery Engine quickly populates a set of Results lists for display. This is done using a proprietary Relevance calculation, tailored for each list, that measures such things as similarity of Industry, Market Cap, Rating factors, and Technical factors, as well as strength of the Power Gauge Rating itself.

In this way, the Chaikin Stock Discovery Engine is the first financial search capability that combines search strength and alpha (expected performance relative to the market).

This is a unique and breakthrough capability.

Why Did We Build This?

We built the Chaikin Stock Discovery Engine as our central, forward-looking platform for generating stock ideas. We wanted to create something that any investor could use to find ideas, with a leading-edge User Experience that delivers on our mission of reducing information overload.

What Netflix has done for movies, Chaikin would like to do for Stocks.

Can I see the calculations that generate the results?

The User Guide will indicate the inputs that each list ‘preferences’ when determining results. However, we will update Relevance calculations over time, and don’t publish exact calculations. Our job is to make sure results are useful, and that the experience feels simple. If we’re doing that, how the magic happens is all under the hood.

Can I search by specific parameters in Discovery?

What makes the Discovery experience work is simplicity. No settings, no parameters. If you want to find results meeting specific criteria, that is what the Screener is for.