Risk management is an important part of any successful investor’s repertoire. Make sure you are managing risk, whether you do so with stops or some other strategy. Once you are holding a stock there are multiple other reasons to consider evaluating that position and selling.

Here are several conditions that you should actively monitor:

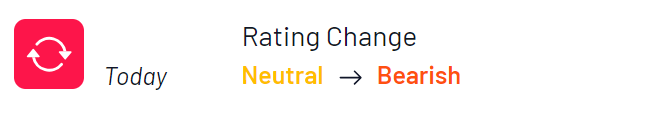

When the Power Gauge Rating turns bearish. Our model is now saying this stock is likely to underperform in the months ahead. (If it turns neutral and all other indicators are still green, you don’t necessarily need to sell.)

When Relative Strength vs the SPY turns red. This is especially true if the Power Gauge Rating has turned neutral or bearish. This is a good time to examine whether it is appropriate to take your profit or cut your losses.

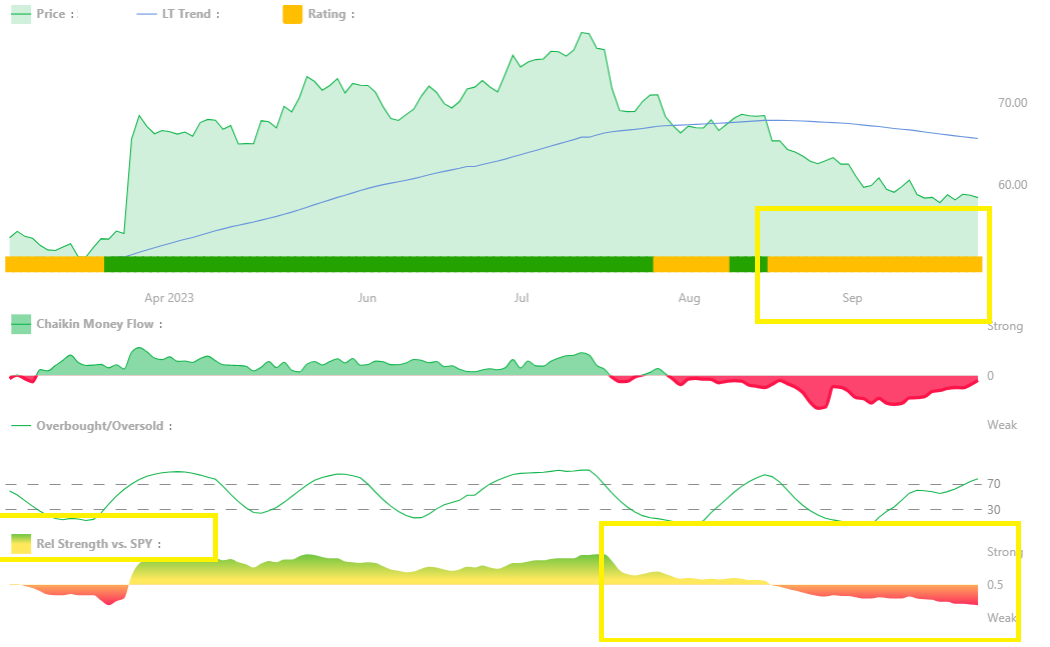

Your stock is making a 52-week high, but Chaikin Money Flow has been bearish for a number of weeks. This often means that institutions are taking profits based on the run up, but they don’t have long-term faith in the stock. This is a sign to evaluate your position, and consider profit taking.

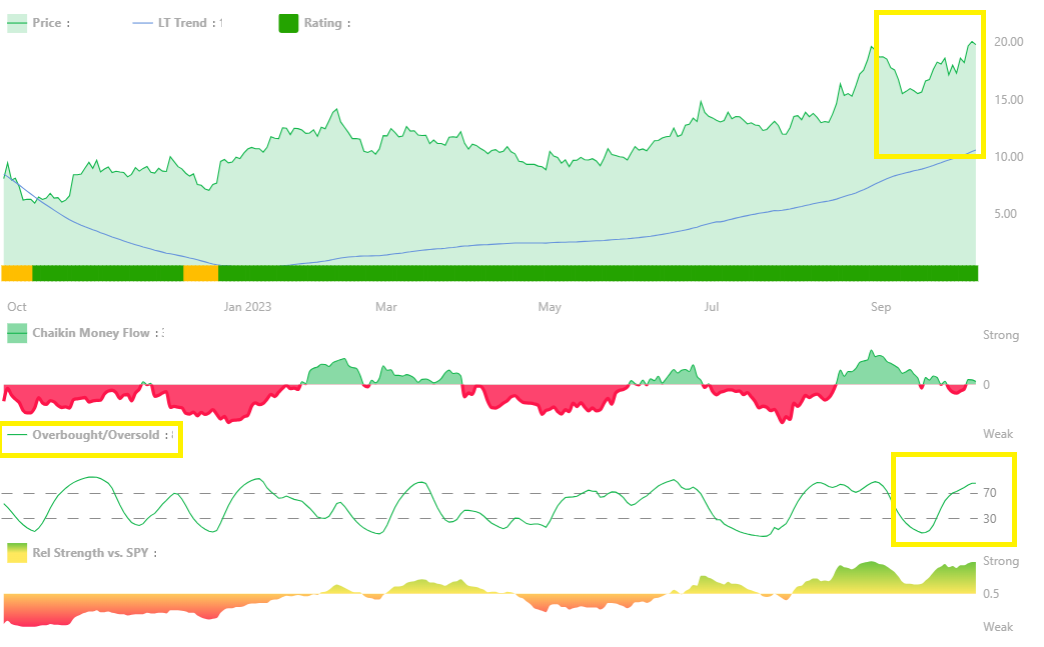

If you are a swing trader, and you bought a stock when it was Oversold, and it has now moved to Overbought, and is at the top of the trading range, this is a good time to take money off the table.