Chart Display

The Chaikin Analytics Chart display shows 5 slices of high-value indicators:

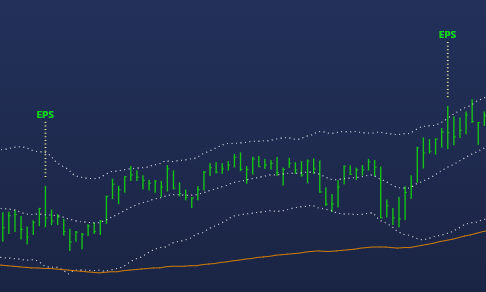

Price, Averages, Bands

- Price Bars – The chart will show historical High/Low/Close bars – either 1 year of daily bars or 5 years of Weekly Bars depending on the time frame selected. Values reflect exchange trades.

- EMA21 (middle white dotted line) – 21-day Exponential Moving Average of closing price.

- Chaikin Bands (upper and lower white dotted lines) – Computed as a percentage above and below EMA21.

- Chaikin Trend (orange line) – 200-day Double-Exponential Moving Average.

How to use it

Chaikin Bands are an indication of a stock’s normal trading range. When a stock hits a band, this is a potential decision point. If the stock drops to a Lower Band and the Power Gauge is Bullish and other factors in your decision process confirm, this can be a good entry point for a stock you are looking to own. Conversely, if a stock rallies to an Upper Band while the Power Gauge and other factors are Bearish, you might consider taking profits.

Intraday Bar

- During the trading day, the most recent bar will reflect the current day’s High, Low, and Last Price, colored Green, Red, or Grey depending on whether the stock is up, down, or unchanged for the day.

- Last sale prices should match the quote displayed in the Chart Header. They are based on values provided by QuoteMedia from the BATS exchange, update once per minute, during and outside of market hours. High and Low values are based on exchange trades during market hours.

- When the nightly update is performed (before midnight U.S. Eastern time), a new historical bar is created and the intraday bar is not displayed. Once a calendar day starts which is a valid trading day, a grey “tick” will display at the Last price until trading activity occurs.

- Other indicators do not update dynamically during the trading day.

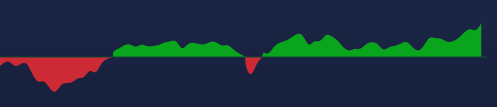

Chaikin Money Flow (CMF)

- Chaikin Money Flow is a proprietary measure of net accumulation (green) or distribution (red). This is a simple, effective way of including volume in your analysis, and has become an industry standard tool.

- A stock which is closing high in its daily range on high volume is considered to be under net accumulation, and conversely a stock closing nearer its daily low on high volume is considered to be under net distribution, as these patterns may reflect institutional trading activity.

How to use it

CMF ranges from +100 to -100. A stock which closes at its high 21 days in a row will have a value of 100. A value of +25 or -25 is considered strong accumulation or distribution.

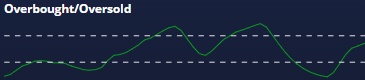

Overbought/Oversold (OB/OS)

This indicator provides a smoothed, scaled cyclical indication of where a stock is in its normal trading range.

How to use it

When OB/OS drops below 30 then turns up, this can be a good entry point when confirmed by the Power Gauge. A level of 70 is considered Overbought.

Relative Strength

This indicator provides a consistently scaled indication of a stock’s recent performance relative to the S&P 500. When the gradient gets to green, this indicates the stock has been strongly outperforming the market. Relative Strength on the SPY chart, will compare SPY to the IWV—the Russell 3000 index which includes a blend of large, mid, and small cap stocks.

How to use it

Periods of very strong (or very weak) relative activity may indicate an underlying shift in the market’s sentiment about a stock which is not yet picked up in the Power Gauge rating.

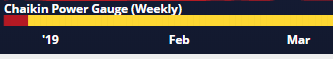

Power Gauge Ribbon

The Power Gauge ribbon shows the historical value of the Rating over time. You can use this as a reference to see how the stock performed relative to the Rating.

To improve visual presentation, for prior weeks, the closing Power Gauge Rating value is shown for all days in the week. For example, if the Rating turned Bullish for a day, but ended the week Neutral, the whole week would display as Neutral.

For the current week, all daily values are shown.

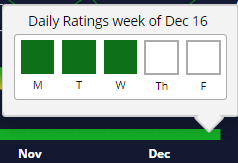

Daily Power Gauge Popup

Hover over any week of the Power Gauge ribbon to see daily values for that week. For the current week, days not processed yet will have a light grey border around them.

Daily Power Gauge values

Color on Chart |

Rating |

|

Very Bullish |

|

Bullish |

|

Neutral + |

|

Neutral |

|

Neutral - |

|

Bearish |

|

Very Bearish |