Chaikin Preset Screens offer pre-set criteria commonly used by our in-house experts to screen for stocks depending the strategy they are looking to implement. These starter screens provide a baseline that you can then edit according to your own needs.

To assist Members in learning how to best use the Screener, we have developed a series of Preset Screens.

Accessing Chaikin Preset Screens:

From your screener page, click on the folder icon for managing your saved screens as shown below:

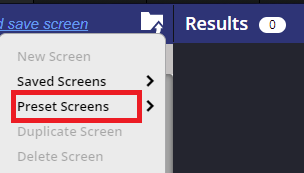

Notice the new menu item “Preset Screens”

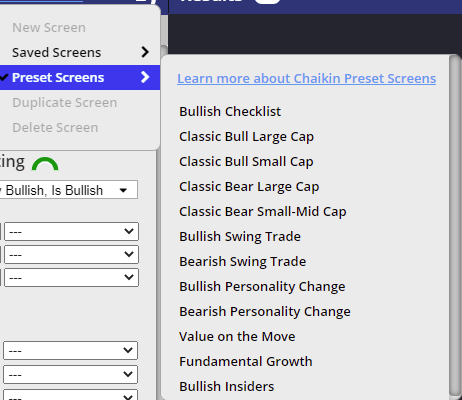

Click on Preset Screens and the list of Preset Screens will appear. Click on the Preset Screen you wish to use and the screen will load.

Click 'Get Results' button at the bottom of the page and the stocks that meet your criteria will appear.

Here are descriptions of each of the Preset Screens.

Bullish Checklist

This screen identifies stocks that are most likely to have positive indicators in all six items measured in the Chaikin Analytics Checklist. Use this screen to identify stocks that rank favorably under the Power Gauge Rating and have strong technical “setups.”

Classic Bull Large Cap

This screen identifies stocks with a strong positive long term trend likely to continue to outperform the broader market. Use this screen to identify ideas for longer term investments dependent on the stock outperforming the broader market over a longer period.

Classic Bull Small Cap

This screen identifies small cap stocks with a strong positive long term trend likely to continue to outperform the broader market. Use this screen to identify small cap ideas for longer term investments dependent on the stock outperforming the broader market over a longer period.

Classic Bear Large Cap

This screen identifies stocks with a strong negative long term trend likely to continue to underperform the broader market. Use this screen to identify ideas for longer term investments dependent on the stock underperforming the broader market over a longer period.

Classic Bear Small-Mid Cap

This screen identifies small/mid cap stocks with a strong negative long term trend likely to continue to underperform the broader market. Use this screen to identify small/mid cap ideas for longer term investments dependent on the stock underperforming the broader market over a longer period.

Bullish Swing Trade

This screen identifies stocks with an oversold condition and strong fundamentals which are likely to increase in price in the short term. Use this screen to identify ideas for short term trades dependent on an increase in the underlying share price over a short investment time frame.

Bearish Swing Trade

This screen identifies stocks in an overbought condition and weak fundamentals likely to decrease in price in the short term. Use this screen to identify ideas for short term trades dependent on a decrease in the underlying share price over a short investment time frame.

Bullish Personality Change

This screen identifies stocks with a recent shift to a Bullish or Neutral Plus Power Gauge rating, an improvement in Relative Strength, and an increase in Chaikin Money Flow. Use this screen to identify ideas for either a short or long term trade benefiting from a shift from neutral or negative prospects to positive prospects.

Bearish Personality Change

This screen identifies stocks with a recent shift to a Bearish or Neutral Minus Power Gauge rating, a decline in Relative Strength, and a decrease in Chaikin Money Flow. Use this screen to identify ideas for either a short or long term trade benefiting from a shift from positive or neutral prospects to negative prospects.

Value on the Move

This screen identifies value stocks with favorable Power Gauge ranks and especially favorable earnings estimate trends. Use this screen to identify value stocks that may have more potential “pop” than is usually assumed for this stereotypically staid category.

Fundamental Growth

This screen identifies stocks with favorable Power gauge ratings and fundamental characteristics that support consistent growth in the future. Use this screen to identify growth ideas that are likely to have more moderate risk than the highest high fliers.

Bullish Insiders

This screen identifies stocks with favorable Power gauge ratings and strong earnings trends whose shares are being bought by company insiders. Use this screen to identify ideas that are supported by the actions of those who presumably know the most about the companies.

Note, we will no longer have a Dividends screen. If you had alerts on the Dividends screen, those will no longer be emailed. If you had alerts on the Classic Bull or Classic Bear screens, the name will automatically change to Classic Bull Large Cap and Classic Bear Large Cap respectively. If you are interested in Dividends, you may select Dividends as an additional variable on any of the Preset Screens.

Editing and saving an updated Preset Screen:

To change or add criteria to a starter screen, simply update the desired filter once you’ve loaded the starter screen into the screener area. Beta as a variable in the Bullish or Bearish Swing Trade Screens. Simply select the desired variable, then click Update Results and the screen will run again with the desired additional variable.

Market conditions will increase or decrease the number of results returned by any of the Preset Screens. By changing the value of some of the variables, you are able to increase or decrease the number of results returned. Client Success is available to assist you with this process.

If you’d like to save this to your own screens, rename the screen in the upper left and click “save” as shown below. Your new screen will now appear in your “Saved Screens”.