Overview

The ETF Comparison page allows you to see detail on any Exchange-Traded Fund (ETFs) listed in the U.S. and compare it to other similar ETFs, in terms of performance, Power Gauge Rating, Chaikin Power Bar, and other key statistics.

Classification

Chaikin classifies all US-listed ETFs according a 3-level hierarchy: ETF Category / ETF Group / ETF Subgroup.

- ETF Category is based on the primary type of asset held by the ETF.

- ETF Group is the primary comparison group of the ETF.

- ETF Subgroup is a more specific set of similar ETFs within the ETF Group.

All ETFs are assigned to one ETF Category and ETF Group. (Most, but not all, are assigned to a subgroup.)

Although many ETFs have multiple characteristics, rules are applied to assign all ETFs to only one Category and Group.

- Inverse ETFs hold a particular asset type as a short position, allowing investors to bet on downside activity.

- Leveraged ETFs are structured to return a multiple of the underlying asset performance. For instance, the SPXL – Daily Direxion S&P 500 Bull 3x Shares – is structured to go up or down in value 3 times the amount of the S&P 500 index on any given trading day. ETFs which are both Leveraged and Inverse are classified as “Inverse”.

- Active ETFs are managed based on the decisions of a fund manager, rather than tracking an index, or implementing a strictly rule-based strategy.

- ETNs (Exchange-Traded Notes) are instruments structured to behave like ETFs, but which are not actually funds holding constituents. They are notes issued by a bank or other institution that promise to match the return of a particular index or trading strategy. There are advantages and risks to ETNs, which any potential investor should be aware of. (See Investopedia article: ETF or ETN – What’s the Difference?)

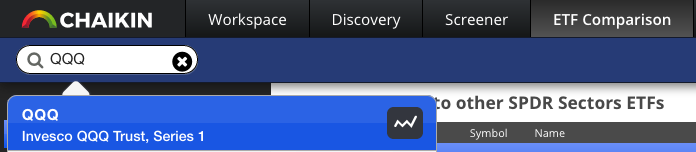

ETF Search

Enter an ETF ticker symbol (such as “QQQ”) into the ETF Search Box to see matching results.

Click on any result to select an ETF and its Group for display in the ETF Comparison page (press <Return> to select the top result).

You can also press the Chart icon to chart the selected ETF in the Workspace.

If you enter the ticker symbol of a stock, you will be prompted to chart the stock in the Workspace.

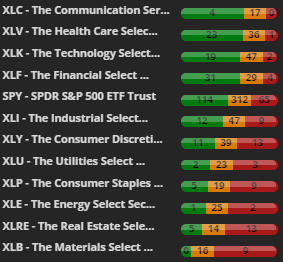

ETF Navigator

Use the ETF Navigator to select an ETF Group or Subgroup for display in the ETF Comparison page.

A selectable Group or Subgroup is followed by the count of ETFs it contains, e.g. “SPDR Sectors (11)“.

U.S. Equity ETFs

ETFs which are listed in the U.S. and hold U.S. equities are the main focus of Chaikin Analytics, since we have Power Gauge Ratings for their constituent holdings.

There are 3 “special” Groups of U.S. Equity ETFs:

- SPDR Sectors

- SPDR Subsectors

- Index ETFs.

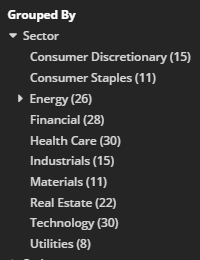

Additionally, U.S. Equity ETFs are grouped by:

- Sector

- Style

- Strategy

- Issuer

SPDR Sectors

Click on SPDR Sectors in the ETF Navigator to see the SPDR Sector ETFs compared to each other, along with the SPY (the State Street S&P 500 ETF).

State Street Global Advisors created the Select Sector SPDR Funds (or “Spiders”) to track the 11 Standard & Poors Sectors. (“SPDR” stands for “S&P Depository Receipts”). They are:

Sector funds represent an excellent way to invest in a specific segment of the U.S. economy, while reducing exposure to individual stocks.

The SPDR Sector Funds contain only the large cap stocks which make up the S&P 500 Index. There are other Sector funds from other issuers.

Chaikin suggests a “top-down” strategy of holding strong stocks in strong Sectors and Industries. The ETF Comparison view makes it easy to see at a glance which Sectors are more heavily Bullish or Bearish than the overall market, including significant changes over the past week.

Often sectors follow an observable “sector rotation”, in coordination with the overall business cycle, where money flows out of one or more sectors and into others. If you keep an eye on this page, you will notice sector rotation patterns over time.

SPDR Subsectors

The S&P Subsectors are comprised of approximately 1000 large and midcap stocks in the S&P Total Market Index, including stocks whose market cap is not large enough to quality for the S&P 500.

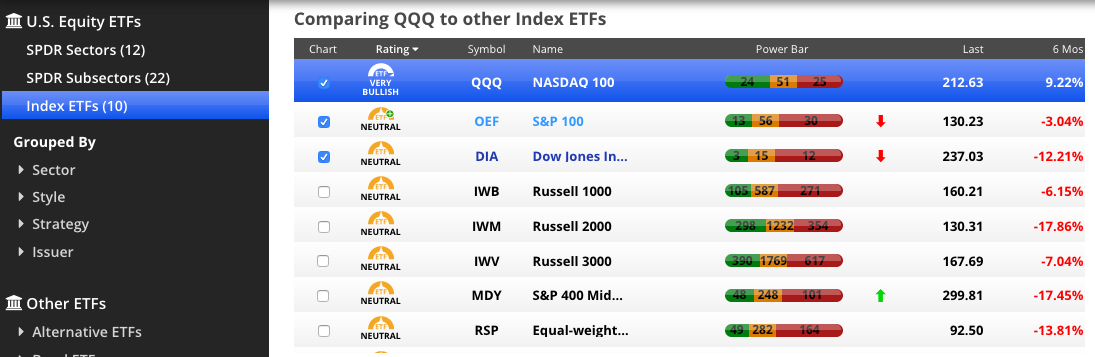

Index ETFs

The Index ETFs Group contains selected common ETFs tracking major U.S. Indexes, allowing you to see at a glance which are more Bullish or Bearish, and which are outperforming.

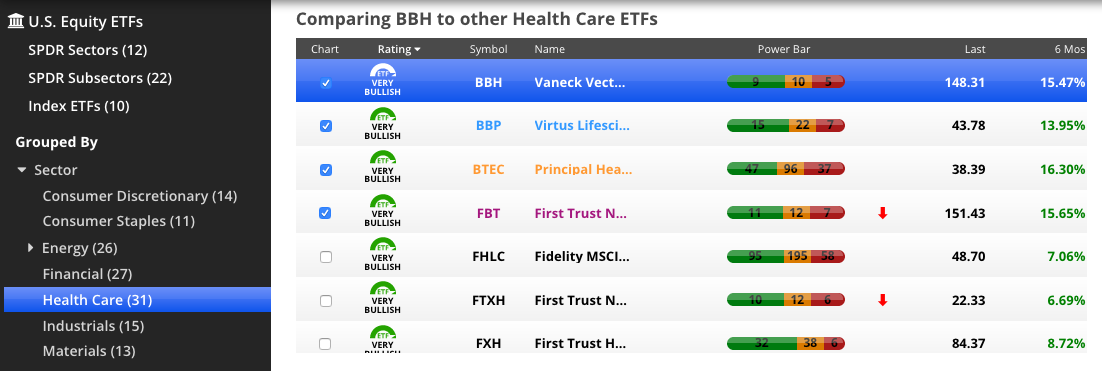

Grouped By Sector

Use the Sector ETF Groups to compare Sector ETFs from various issuers

For instance, select “Health Care” to see various Health Care ETFs compared to each other:

You’ll quickly see that not all ETFs which cover the same Sector are created equal.

This is an important starting point when considering investing in an ETF.

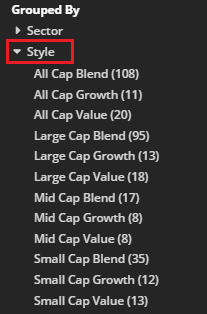

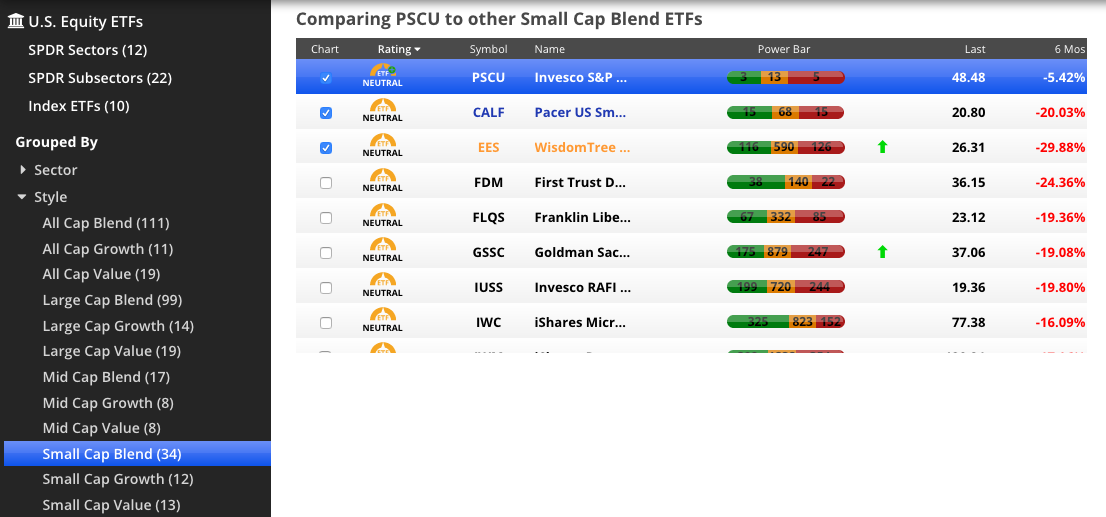

Grouped by Style

The most common U.S. Equity ETFs hold stocks based on a combination of Market Cap and Growth/Value style:

Select any of these to compare ETFs of that Style grouping, for instance, all Small Cap Blend ETFs.

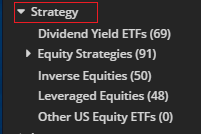

Grouped by Strategy

Select an ETF Group in the “Strategy” section to compare ETFs which share a common strategy or fund structure. Groups included in this section are:

- Closed End Funds. While technically, not ETFs, Closed End Funds (“CEFs”) are similar in that they exchange-listed instruments, with an underlying portfolio of holdings, which trade intraday, unlike mutual funds, which are only priced at the close of trading. They are actively managed and issue a fixed number of shares. This Group contains a variety of CEFs which hold U.S. Equities.

- Dividend Yield ETFs. ETFs which hold stocks that offer a high, or consistent, dividend yield.

-

Equity Strategies.

- Ethical ETFs. ETFs which hold stocks based on a values of social responsiblity, from Biblical Responsibility funds to Women in Leadership funds.

- Momentum ETFs. ETFs which hold stocks that have exhibited notable price momentum.

- Additional Equity Strategy ETF subgroups may be found here as they are created.

- Inverse Equities. Contains a variety of ETFs which hold U.S. stocks as short positions, allowing investors to bet on downside activity. These may also be “leveraged” (see below).

- Leveraged Equities. Contains long-only ETFs which are structured to return a multiple of the underlying asset performance. For instance, the SPXL – Daily Direxion S&P 500 Bull 3x Shares – returns is structured to go up or down in value 3 times the amount of the S&P 500 index on any given trading day. ETFs which are both Leveraged and Inverse are in the Inverse Equities group.

Grouped by Issuer

Select an Issuer from this section to compare all of the U.S.-listed ETFs from that Issuer.

Other ETFs

Other ETFs hold positions which are not U.S. equities, and have their own sections in the ETF Navigator.

Chaikin does not provide Power Bar breakdowns for these ETFs, but most Fixed Income and Global Equity ETFs will have Power Gauge Ratings. However, all other information is available.

These consist of:

- U.S. ETFs holding instruments other than equities (or with an “alternative” fund structure), and

- Global ETFs, which are U.S.-listed funds holding any non-U.S. assets.

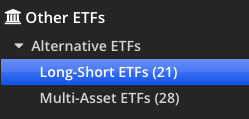

Alternative ETFs

The Alternative ETFs section contains groups of funds which either hold U.S. instruments other than stocks, bonds, or commodities – or which have a non-traditional fund structure.

These include listed Hedge Funds, Hedged Strategy ETFs, Long-Short ETFs, Multi-Asset ETFs, Options Strategy ETFs, Volatility ETFs, and other miscellaneous alternatives.

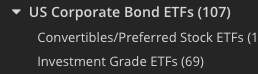

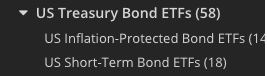

Bond ETFs

The Bond ETFs section includes groups of ETFs holding various types of U.S. fixed income securities.

- Inverse Bond ETFs. Contains a variety of ETFs which hold U.S. bonds as short positions, allowing investors to bet on downside activity.

- Leveraged Bond ETFs. Contains long-only ETFs which are structured to return a multiple of the underlying asset performance.

- Mortgage-Backed Bond ETFs. Funds holding bonds secured by a mortgage or pool of mortgages.

- Municipal Bond ETFs. CA Municipal Bond funds, National Municipal Bond funds, NY Municipal Bond funds.

- Total US Bond Market ETFs. Funds holding a cross-section of US fixed-income securities.

-

US Corporate Bond ETFs. Various groups of funds holding debt issued by U.S. companies.

- Convertibles/Preferred Stock ETFs. Funds holding convertible debt or preferred stock issued by US companies.

- Investment Grade ETFs. Funds holding highly-rated debt issued by U.S. companies.

- US Treasury Bond ETFs. Various groups of funds holding US government debt securities.

Commodity ETFs

The Commodity ETFs section includes groups of funds holding physical U.S. commodities: Agricultural Commodity ETFs, Broad Commodity ETFs, Energy (Oil & Gas) ETFs, Industrial Metals ETFs, and Precious Metals ETFs.

- Inverse Commodity ETFs hold US commodities as short positions. These are generally structured as ETNs.

- Leveraged Commodity ETFs hold US commodities in leveraged fashion, returning a 2x or 3x multiple of performance. These are generally structured as ETNs.

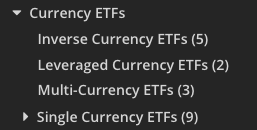

Currency ETFs

The Currency ETFs section includes ETFs tracking single-currencies or holding multi-currency baskets.

- Inverse Currency ETFs hold currencies as short positions.

- Leveraged Currency ETFs hold currencies in leveraged fashion, returning a 2x or 3x multiple of performance.

Global ETFs

The Global ETFs section includes all ETFs holding international issues of all asset types (Alternatives, Bonds, Equities).

Settings

- x Include Active ETFs. Check this box to include actively managed funds in your results. By default, they will be shown.

- x Include ETNs. Check this box to include Exchange-Traded Notes in your results. By default, they will be shown.

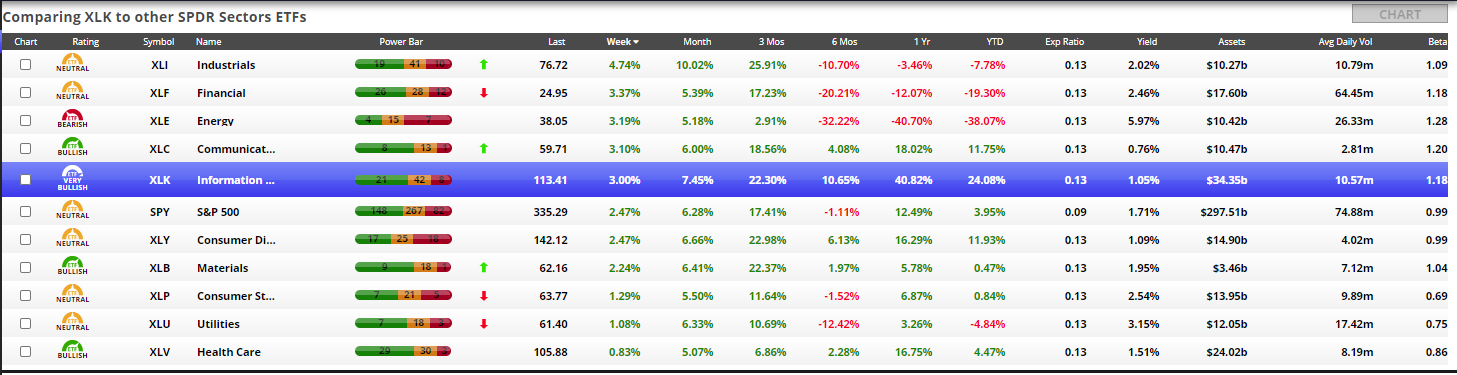

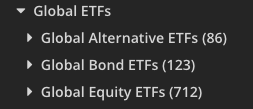

Comparison Table

The ETF Comparison Displays as a table in the default view. We have discontiued the view that contains a partial table and a partial chart and now display the full table as the default.

Normal Mode

When an ETF Group is first loaded, by default results are ordered most Bullish to most Bearish by Power Bar, or by 6- month performance if no Power Bar is available.

In Normal Mode, the following fields are shown:

- Chart. Check box to select which ETFs to show in the Comparison Chart. By default, the top 4 are selected.

- Symbol. Ticker symbol of the ETF.

- Name. Name of the ETF. If it is cut off, hover to see a popup showing the full name.

- Power Bar. Chaikin Power Bar showing Bullish/Neutral/Bearish breakdown of ETF constituent holdings. Shown for U.S. Equity ETFs only.

- Weekly Mover arrow. Green or Red up/down arrows are shown next to the ETFs in the group with the 3 biggest positive and negative changes in Power Bar rank over the past week.

- Last. Current ETF price per share (within 1 minute, during trading session).

- Week, Month, 3 Mos, 6 Mos, 1 Yr, YTD. Percent change over 1 week, 1 month, 3 months, 6 months, 1 year, and Year-to-date.

- Exp Ratio. The expense ratio of the ETF.

- Yield. Annual dividend yield of the ETF.

- Assets. Assets under management of the ETF.

- Avg Daily Vol. Average daily shares of the ETF traded over the past month.

- Beta. Correlation of ETF performance to the S&P 500 index, ranging from -1 to 1.

Click a column heading to sort by that column descending, and again to sort by that column ascending.

Chart Mode

To view selected ETFs with Charts, you simply select the ETFs you wish to view by clicking on the box next to the ETF's Name to check that box. Then, click on the Chart Icon at the top right of the Screen and the Chart view will appear.

The table will be partially suppressed and the chart will appear as shown below.

Click on Hide Chart to return to the default Table view.

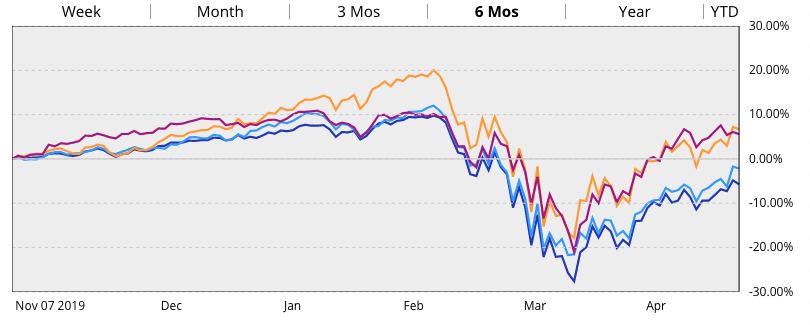

Comparison Chart

The Comparison Chart shows relative performance of selected ETFs over a time period, indexed to a starting point.

Six month performance is shown by default, or you can select Week, Month, 3 month, Year, or Year-To-Date.

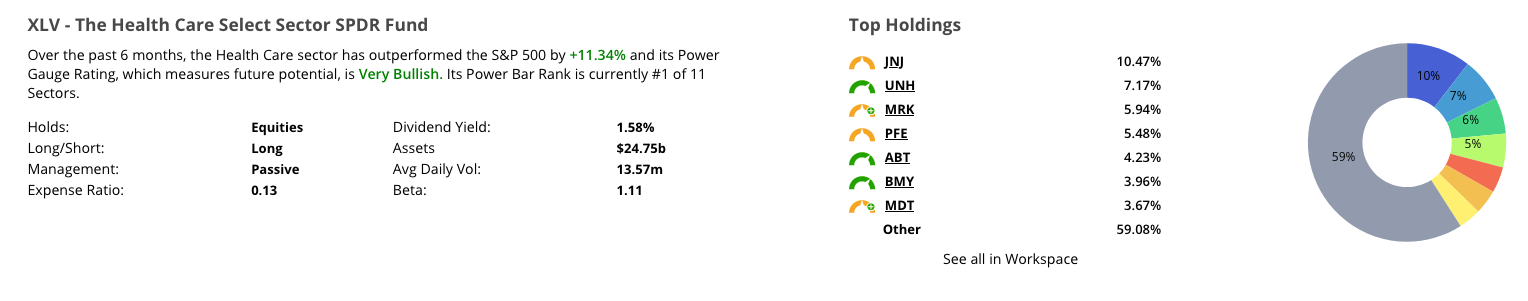

ETF Summary & Holdings

Click on an ETF in the Comparison Table to display its Summary and Top Holdings breakdown.

Summary

The Summary at left recaps the ETF’s recent performance, Power Bar score, and key information.

- Holds. Type of assets held by the ETF.

- Strategy. Long, Short, Leveraged or a combination of these.

- Management. Active or Passive.

- Dividend Yield. Annual dividend yield of the ETF.

- Assets. Total assets under management in the fund. Proceed with caution before investing in funds with very low assets.

- Avg Daily Vol. Average daily shares of the ETF traded over the past month. Be more cautious when considering investing in illiquid ETFs.

- Beta. A measure of correlation between the ETF and the S&P 500, ranging between -1 and 1.

Top Holdings

The Top Holdings breakdown at right shows a list and chart of the ETF’s top 7 holdings by weight.

Click “See all in Workspace” to switch to the Workspace, with all of the ETF’s holdings displayed in the Watchlist.

Holdings are available for U.S. Equity ETFs.

Sector/ETF FAQs

• What are the SPDR Sectors and how can I use them in my investments?

• What analytics does Chaikin provide for Sectors?

• How are Sectors and Sector ETFs determined?

• What is the difference between ‘Sectors’, ‘Sector Indexes’, and ‘Sector ETFs’?

• Are there other Sector ETFs besides the SPDRs?

• What changes are being made to the Financial Sector?

• How are Subsectors different from Industry Groups and Industries?

What are the SPDR Sectors and how can I use them in my investments?

SPDR Sector ETFs, issued by State Street Global Advisors, are the largest and most liquid Exchange-Traded Funds designed to track the overall market sectors of the U.S. economy. They are comprised of the 500 large-cap stocks in the S&P 500 index. They divide the index based on Sector classification, and are weighted based on the market cap of their constituent stocks.

What is ‘Sector rotation’?

“Sector rotation” refers to the tendency of market sectors to behave roughly in phase with the larger economic business cycle – Expansion, Contraction, Recession, or Recovery. For instance, as the Energy Sector remained weak in response to lower oil prices through the latter half of 2015, investors moved into the more conservative Utilities sector, driving it up in early 2016.

Helpful links:

• Overview of Sector Rotation from Investopedia.

• Sector investing and the Business Cycle from Fidelity.

What analytics does Chaikin provide for Sectors?

In addition to the Sector Performance View, Chaikin provides charts for Sector ETFs, with technical analytics including moving averages, trading bands, Chaikin Money Flow, Relative Strength, and Overbought/Oversold indicators, Relative Strength Buy/Sell Signals, and “Power Bars” which show the Bullish/Neutral/Bearish breakdown of Chaikin Power Gauge ratings for stocks in the Sector.

How are Sectors and Sector ETFs determined?

In 1999, Standard & Poor’s and MSCI Barra jointly developed the Global Industry Classification Standard (GICS®) to establish a global standard for categorizing companies into sectors and industries. It allowed for consistent designations of companies in different markets, using a four-level hierarchy: Sectors, ‘Industry Groups’, Industries, and Subindustries. There are 10 Sector classifications.

Standard & Poors created S&P 500 Sector Indexes based on the GICS Sector designations, which include the stocks in the large-cap S&P 500 Index for each of the 10 Sectors.

State Street Global Advisors, which had created the popular SPDR S&P 500 ETF (SPY), issued “SPDR Select Sector ETFs” — Exchange-Traded Funds which track the S&P Sector Indexes. These are by far the largest and most liquid Sector ETFs.

Though there are 10 Sector codes and Indexes, there are only 9 Sector ETFs. (There are not enough S&P stocks in the Telecommunications Sector to meet the minimum ETF listing requirements, so this Sector is folded into the Technology Sector ETF).

Helpful links:

• S&P Dow Jones Industry Indices

• About SPDR Select Sector ETFs

What is the difference between ‘Sectors’, ‘Sector Indexes’, and ‘Sector ETFs’?

“Sectors” or “Sector codes” are a classification scheme. Indexes are created to track specific Sector codes – but you can’t invest directly in an index. For that, you need a fund.

“Sector ETFs” are funds you can invest in, which track Sector Indexes. They have certain requirements that Indexes don’t, and their constituents or weightings may reflect these differences.

The SPDR Sector ETFs were created to track the S&P Select Sector Indexes, which are based on the S&P/MSCI GICS classifications. There are 10 Sector codes and Indexes, but 9 ETFs which track them.

Are there other Sector ETFs besides the SPDRs?

Yes, other companies offer Sector ETFs including Blackrock’s iShares, First Trust, and Vanguard.

These are accessible from the ETFs section of the List Navigator.

What are the recent changes to the Financial Sector?

In 2014, S&P announced they would be breaking apart the Financial Sector classification into a Real Estate Sector and a Financial Services sector, to better reflect the growing and changing dynamics of the Real Estate investment industry, whose fundamentals are the least correlated with other groups in the Financials Sector. That designation goes into effect at the end of August 2016. In 2015, State Street issued the XLRE and XLFS Select Sector ETFs to track the new designations. These are mostly appropriate for money managers who follow a strict GICS discipline. The XLF SPDR Financial Sector ETF continues to be traded, and currently dwarfs the XLRE and XLFS in assets and trading volume. While this is the case, Chaikin will use the XLF in its Sector lists.

What are Subsectors?

The 20 ‘Subsectors’ in Chaikin Analytics are the State Street ETFs which track Industry Groups. Most of them are benchmarked to one of the Standard & Poors Select Industry Indexes, which are comprised of groups of related Subindustries, They consist of around 1,000 stocks chosen from the S&P Total Market Index, which includes companies whose market cap is not large enough to qualify for the S&P 500, and are constructed using a modified equal weighting system.

In some cases, such as the Technology Subsectors, State Street uses a provider other than Standard & Poors for its benchmark indexes.

How are Subsectors different from Industry Groups and Industries?

The terminology around “Industries” can get a bit confusing. Here’s the rundown:

- S&P/MSCI in their GICS classifications uses the following 4 levels: Sector/ Industry Group/ Industry/ Subindustry

- However, the term “Industry Group” is not often maintained by other information providers, and the term “Industry” has various, similar meanings across providers.

- Chaikin Analytics has used the terms “Industry Group” and “Industry” interchangeably since our inception, and we use “Industry” to refer to the S&P Industries we display in the application. These are also based on GICS classifications. State Street calls their ‘Subsector’ level ETFs, “SPDR Industry ETFs”.

- For these reasons, we use the term “Subsectors” to refer specifically to State Street’s ‘subsector level’ SPDR ETF classification. We use this term in the Markets Menu drop-down, the List Navigator, and the Sector Performance view. Many other vendors also use this term.

S&P: Industry Groups, State Street: Industries, Chaikin: Subsectors.

They all refer to groupings of related Industries at the sub-sector level.